How the Magic 8 Complement the Magnificent 7 Mammoths Driving the Market Two new...

Global ETF Monitor The SEC's decision on Crypto ETFs in the US is eagerly awaited by...

Investing in NATO Defence Tapping into Growing Security and Cybersecurity Spending ...

Capitalising on Higher Interest Rates Positive Returns driven by Higher Interest Rates. ...

Harnessing Social Sentiment with AI ETFs tracking “meme” and “mania” stocks can display...

Electric Vehicles: Adding China to the US Tesla is not the only player Tesla shares...

Enhancing Dividend Income through Buy-Write Strategies Does an index or a discretionary...

Playing the Artificial Intelligence (AI) Revolution Spreading bets across industries,...

Inflation Protection and Upside from California’s Carbon Ambitions In Europe, the...

Can technology find real estate growth stories? Real estate and technology are...

How should investors best seek inflation protection? Fixed income and credit investors...

Active transparent ETFs cost only slightly more than passive trackers Chinese...

Getting exposure to DeFi, DEX, DONs, Dapps and Smart Contracts Lower Cost ETPs for...

A pragmatic approach to ESG and energy transition combines fossil fuels with...

Subversive ETFS Subversion, or criticism of the government, in totalitarian regimes,...

BlockRock actively managed floaties ETF BlackRock is launching an actively managed...

NightShares stays awake during the day, and gears during the night NightShares, the...

CSOP launches Vietnam ETF CSOP Asset Management, one of the fastest-growing Hong Kong...

iShares caves and launches blockchain ETF iShares, one of the final holdouts, has well...

Charles Schwab launches cheapest ever municipal bond ETF Charles Schwab, kingpin US...

WisdomTree launches car themed ETF WisdomTree has launched its ninth thematic ETF in...

KranesShares targets Asian dividend aristocrats KraneShares, the China ETF specialist...

21Shares doubles down on ethereum Swiss crypto ETF specialist is rolling out two new...

AllianceBernstein joins ETF industry at last AllianceBernstein, one of Wall St’s...

BondBloxx launches ultra-low fee specific duration US treasuries BondBloxx, a New...

DWS India government bond DWS has launched Europe's second rupee denominated Indian...

Defiance launches first short blockchain companies ETF Independent New York based ETF...

ETC Group launches merge-rejecting Ethereum ETF ETC Group, one of the largest crypto...

LGIM launches world’s first photonics ETF Legal and General is widening out its...

Franklin Templeton undercuts metaverse ETFs on price Californian funds giant Franklin...

BlackRock adds neuroscience ETF to thematic lineup iShares is buffing up its thematic...

China bonds in USD hedge Independent Hong Kong ETF provider Premia Partners has...

BlackRock launches active thematic ETF BlackRock is launching an actively managed...

Inspire changes ESG ETF names, blames “liberal activism” Inspire ETFs, a Christian...

Agnostic energy ETF, backed by Thiel and Ackman A new ETF provider backed by Peter Thiel...

Vanguard launches two ESG ETFs Vanguard has launched two new ESG ETFs in Europe that...

ETFs target single treasuries F/m Investments, an ETF newcomer based in Washington DC,...

Ultra-cheap gold ETF Franklin Templeton is entering the gold ETF game, launching a...

Charles Schwab launches crypto equity ETF Charles Schwab, the discount broker, is...

Sprott joins with Canadian Mint to launch gold ETF Canadian commodities ETF specialist...

ESG screened junk bonds from DWS DWS is launching two new EUR and USD denominated junk...

Energy transition commodities Harbor Capital, the Chicago based fund manager, is...

Single stock L&I come to the US AXS Investments, a New York based asset manager, is...

Actively managed SPAC ETF RiverNorth and TrueMark have teamed up to launch an actively...

BlackRock launches online entertainment and education BlackRock is throwing its...

New ETF targets the night effect ETF newcomer NightShares has launched two intriguing...

21Shares radically underprices competitors Swiss crypto specialist 21Shares has...

Duration and debt levels managed EM bond ETF BondBloxx, an ETF newcomer that focusses...

VanEck launches space themed ETF Europe is set to get another space-themed ETF, with...

iShares inflation hedged AGG and HYG iShares has listed three new bond ETFs that provide...

Betting against bitcoin ProShares has launched the first American inverse bitcoin ETF,...

Iconic Funds launches ApeCoin ETP German crypto ETP specialist Iconic Funds has...

Optimize Advisors takes earnings signals from the options market ETF newcomer...

"ESG" orphans bets on mean reversion ETF newcomer Constrained Capital has launched an...

Ocean health ETF A newcomer to the ETF industry called Newday Impact is listing an...

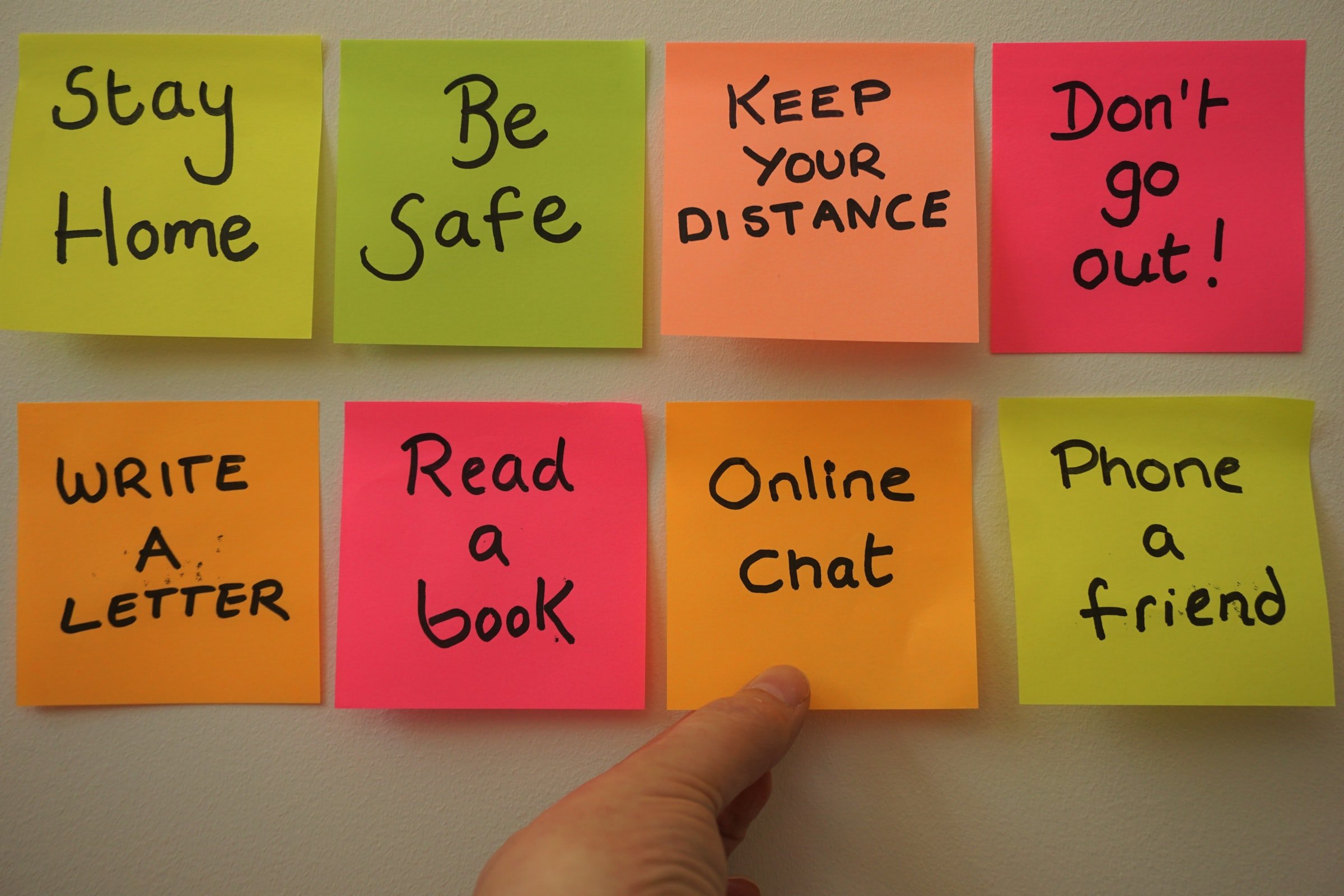

Procure launches disaster relief ETF Procure, the boutique ETF provider that invented...

KraneShares electric cars in Europe KraneShares, the New York ETF provider majority owned...

Direxion launches breakfast commodities ETF Direxion, the leveraged and inverse ETF...

PGIM recreates floaty mutual fund as an ETF PGIM has launched an actively managed...

Bond, Bruce Bond, Launches managed floor ETFs Bruce Bond, the legendary founder of...

Texan tactical asset management STF Management, a Texan asset manager, has launched its...

Specifically rated junk bond ETFs BondBloxx, the ETF newcomer specialising in bond...

Fidelity joins swelling metaverse throng Asset management giant Fidelity has joined the...

Horizons copper ETF Mirae subsidiary Horizons ETF is launching Canada’s first copper...

Grayscale brings GFOF to Europe Grayscale, manager of the world’s largest bitcoin trust,...

Seems like it’s all bad news for cryptocurrency at the moment… Switzerland, Nordics ...

SSGA liquidity-based bond ETF State Street has partnered with bond trading platform...

AdvisorShares launches drone ETF AdvisorShares, an actively managed ETF specialist known...

Invesco launches swap-backed China ETFs Invesco has launched Chinese plain vanilla equity...

Merk launches stagflation ETF Those worried about high inflation and low GDP growth now...

Battery metals commodities ETFs

EV charging infrastructure European white-labeller HANetf has launched another global...

BlackRock gets serious about thematics BlackRock has started listing new thematic ETFs...

ByteTree launches bitcoin + gold ETF ETF industry newcomer ByteTree Asset Management is...

First Trust brings its smart grid ETF to Europe First Trust, the Wheaton, Illinois-based...

DWS China technology DWS, the asset management arm of Deutsche Bank, is launching an ETF...

ETFS/Cosmos launch Australia’s first bitcoin ETFs Australia is about to get its first...

Green Buildings ETF Global X, the subsidiary of Korean finance giant Mirae, is launching...

ProShares files for an inverse bitcoin ETF ProShares has lodged a prospectus with the SEC...

ProShares supply chain ETF Leveraged and Inverse ETF specialist ProShares is launching...

First Sandbox ETP, the video game crypto 21Shares is launching the world’s first The...

Rize launches pet care ETF Rize ETF, a London-based independent ETF issuer, has...

Leveraged and inverse VIX ETFs are back ETF newcomer Volatility Shares has launched two...

Goldman Sachs launches another multifactor ETF Goldman Sachs has launched another...

KraneShares all colours of decarbonisation KraneShares, the New York ETF firm majority...

Proshares launches metaverse ETF Leveraged and inverse ETF specialist ProShares is adding...

ETC Group launches metaverse ETF ETC Group, the crypto ETF specialist, is launching...

VanEck bitcoin miners VanEck is launching a bitcoin miners ETF, in what is quickly...

Evolve launches mildly geared FANGMA ETF Canadian small independent ETF issuer Evolve...

WisdomTree adds four more leveraged ETFs WisdomTree has launched four more speculative...

RSX – the price discovery of ETFs Thanks to sanctions, there is no way for foreign...

Blackstone and State Street launch high income ETF State Street and Blackstone (not to...

VanEck launches Indian internet ETF VanEck has launched an Indian digital economy ETF...

Staff happy with their bosses ETF Chicago-based Harbor Capital is launching an ESG ETF...

Sector junk bond ETFs from BondBloxx ETF newcomer Bondbloxx has launched seven...

Amplify emerging markets fintech Independent ETF provider Amplify is launching an...

WisdomTree targets technology-focussed real estate WisdomTree has launched a property ETF...

Fidelity joins the crypto hunt Fidelity has launched a bitcoin ETF in Germany, becoming...

Goldman joins clean energy rush Goldman Sachs is launching another thematic ETF, this...

DWS launches market timing junk bond ETF DWS is launching another junk bond ETF, this...

More psychedelics ETFs The United States is set to get its third psychedelics ETFs, which...

Disruptive materials from Global X Mirae Asset subsidiary Global X is launching a new...

Grayscale gets into thematic ETFs Grayscale, the company most famous for its $24b closed...

Read More

Read More

News, etf, bernie thurston, etfs, crypto, coinshares, staked, staking, zero fee, tezo, polkadot

CoinShares staked Tezos and Polkadot ETPs share the staking rewards Crypto ETP specialist...

Shipping and air freight ETF US Global Investors, a Nasdaq-listed asset manager with a...

Gambling, Drugs and Alcohol Lets see how many firewalls block this email.. this ETF was...

WisdomTree Active Gold WisdomTree combines gold miners and gold futures USA Gold...

Fooled By Google The Motley Fool adds two more USA The Motley Fool, the brokerage...

21Shares altcoin basket ETF Swiss crypto ETF specialist 21Shares has launched another...

Today, Ultumus and Vyne announce a strategic partnership between Ultumus’ global ETF and...

Cathy Wood launches indexed transparency ETF Cathy Wood is launching an index tracking...

WisdomTree launches different take on biotech WisdomTree has launched a new take on...

Roundhill launches ETF for Wall St Bets Thematic ETF specialist Roundhill is launching...

VanEck active food innovation Hungry VanEck has launched a food innovation ETF that is...

WisdomTree launches three more crypto ETFs WisdomTree is deepening its push into...

Mirae and Evolve list radically different Metaverse ETFs simultaneously Canada is set to...

Invesco launches competitor bitcoin ETF Invesco has become the first major asset manager...

Asia Pac high yield REITs from Singaporean manager Singaporean independent fund manager...

Direxion launches nanotechnology ETF, closely following ProShares Direxion has launched...

21Shares launches world’s first crypto ETPs Swiss crypto ETF issuer 21Shares has just...

Goldman Sachs launches three more actively managed thematic ETFs Goldman Sachs has...

Chinese government bonds from State Street State Street has become the third European...

VanEck green metals ETF VanEck, the Wall St giant behind the $14.5M gold miners ETF...

Rize ETF launches payments ETF Rize ETF, the London boutique backed by Martin Gilbert,...

VanEck launches smart homes active ETF The European subsidiary of VanEck is launching...

Harvest targets online gambling and video games Harvest Portfolios Group, an...

Impact Shares goes to the UN Impact Shares, the not-for-profit ETF issuer backed by...

Europe’s first physical carbon ETC SparkChange, an environment-focussed technology and...

LGIM launches Indian bonds ETF LGIM has listed an Indian bond ETF that aims to make the...

Roundhill Investments launches digital infrastructure ETF Small thematic ETF specialist...

Valkyrie and VanEck come to the party The US is getting two more bitcoin futures ETFs,...

Newcomer Fount lists metaverse and subscription ETFs South Korean robo-adviser Fount is...

Proptech ETF from ETF Managers Group ETF Managers Group is launching the world’s first...

Bitcoin update: ProShares futures-based bitcoin ETF received $993 million in inflows...

America’s first bitcoin ETF The long wait is over. The United States, after eight years...

Blackrock launches bond ETF to out-yield AGG iShares is launching a smart beta bond ETFs...

KraneShares launches active ETF of ETFs KraneShares, the New York China ETF specialist,...

Fidelity launches thematic ETFs, aimed at under-pricing Mutual funds giant Fidelity has...

Invesco launches two blockchain ETFs Invesco has launched two new blockchain ETFs,...

More Carbon ETFs from KraneShares in a growing trend KraneShares, a New York ETF...

Amundi halves the cost of Emerging Markets

Thematic tech from ProShares Leveraged and inverse ETF specialist ProShares has launched...

Smart beta emerging markets from Northern Trust

Abrdn launches industrial metals commodity ETF

Psychedelics ETF AdvisorShares, an ETF provider known for its edgy thematic ETFs, has...

Dimensional converts two more funds into ETFs Legendary quant house Dimensional Fund...

Global X launches solar and wind ETFs Mirae subsidiary Global X is launching solar and...

Norilsk lists carbon neutral nickel ETF Russian nickel mining giant Norilsk has launched...

Asian junk bond ESG Tabula, the London-based bond ETF boutique, has launched the worlds...

WisdomTree brings back carbon ETF WisdomTree is re-opening its carbon futures ETF, after...

HANetf adds to Europe’s swelling cleantech pile European white-labeller HANetf is teaming...

Carbon negative (apparently) bitcoin ETF Alberta-based fintech Accelerate is entering...

iClima goes to the US London ESG consultancy iClima is making its entrance into the US...

Rize rises to ESG sunrise London-based independent ETF issuer Rize has launched an...

Amplify launches thematic-of-thematics ETF, combating cannibalisation New York-based...

SIX Strengthens ETF and Managed Data Service Offering with Acquisition of ULTUMUS

Alveo integrates data services from ULTUMUS to help customers more quickly integrate...

Jane Lemmon joins ULTUMUS recreating the old DeltaOne Solutions team

ULTUMUS one of the contenders for " The Most Influential Financial Technology Company of...

Providing Clarity on Fixed Income ETFs

Passive benchmarking implementations tend to have a Darwinian approach to “survival of...

This article is written in response to the fact that a number of European ETF issuers are...

I have been involved in “Big Data” prior to the days of it actually becoming a “a thing”,...

Equity Indices with the laspeyres calculation methodologies can get complicated enough,...

Read More

Read More

News, msci rebalance, QIR, MSCI reclassification, lebanon frontier, lebanon, MSCI quarterly Index Rebalance

As per their initial consultation in 2020. MSCI is planning on removing Lebanon, due to...

As per their initial consultation in 2019. MSCI is planning on elevating Iceland into the...

ETFs by their very nature are designed to be simple, transparent and tradeable,...

SIX is pleased to announce that it has partnered with ULTUMUS, the international London-...

USA: Euclid launches active ETF of ETFs Europe: HSBC launches China tech ETF USA ...

Clean energy boost Interesting to be writing this on the anniversary of the conjunction...

Hong Kong Listing Following on from Trumps executive order blacklisting 35 Chinese...

CANNABIS, GAS and POLITICAL CONTRIBUTIONS

USA America Century lists opaque active value and growth ETFs American Century, the...

November 2020 Calendar: November-Ultumus-Rebalance-Schedule-2020 Download November is a...

ETF newcomer Esoterica Is listing a new actively managed 5G ETF. The Esoterica NextG...

ETF and Benchmark managed data service provider ULTUMUS has appointed Adam Herrington as...

All this is the release note for the new improvements that where released to the platform...

ULTUMUS has now loaded and made available in their system the preliminary FTSE Russell...

Leuthold Group enters ETF market Research firm Leuthold Group is entering the ETF...

As we get to the culmination of the debacle that is 2020, we decided to review the...

Speedread: Europe: BlackRock lists self-driving car and short duration bond ETF London:...

Global X lists more thematic ETFs Mirae Asset subsidiary Global X is positioning itself...

USA Christian take on ESG Inspire, the Christian ETF provider, is listing a new ETF that...

ChinaAMC lists actively managed index tracking Chinese semiconductor ETF ChinaAMC, one of...

New Zealand The New Zealand Exchange – which runs the country’s exchange and doubles up...

Uranium ETF Uranium is mostly known to investors for its use in nuclear weapons and its...

USA Another coronavirus ETF ETF Managers Group has come in first in the race to roll out...

21Shares, the leading Swiss Crypto ETP provider, has chosen Ultumus, the ETF and Index...