Understanding Corporate Actions

About Corporate Actions

Corporate Actions are important events that can relate to a company as a whole and/or its shares, bonds, other instruments.

Historical Perspectives

The oldest corporate actions are as old as the first companies. The oldest continuously operating company is Japanese construction firm, Kongo Gumi, founded in 578 AD. The Dutch East India Company, established in 1602, is thought to be the oldest joint stock company, which had multiple shareholders that needed to be informed of corporate actions.

Role in Financial Markets

Corporate actions will often have a substantial impact on prices and trading volumes of shares and bonds. For instance a takeover bid is nearly always at a premium to the recent share price and conversely shares tend to fall by the amount of the dividend when they go ex-dividend.

Contact Us For More Information

Operational Considerations in Corporate Actions

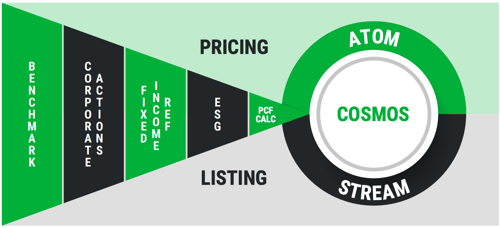

Corporate Actions Data Delivery

Delivery Mechanisms

Delivery Mechanisms

Integration with CSDs and Custodians

Integration with CSDs and Custodians

Data Formats and Standards

Data Formats and Standards

Integration with Trading Platforms

Integration with Trading Platforms

Corporate Actions Prediction and Performance

Impact on Market Performance

Over time, dividends can make up a high proportion of equity market returns. Takeover offers can also account for a high share of equity market performance in any year.

Predictive Analysis

Some predictive analysis is relatively straightforward. Once dividends are announced, it is very rare for companies to cut or cancel them, absent extreme events such as the Covid crisis, a natural catastrophe or fraud.

Risk Management

Risk management should consider the costs and risks of missing deadlines, incorrectly interpreting a corporate action or applying the wrong rates of withholding taxes.

Corporate Action Solutions

A tailored data solution can accommodate different investor preferences for handling corporate actions. Automation should improve efficiency and reduce errors.

Data Procurement

International Data Sources

Corporate actions take place in over 100 countries and some individual countries, such as the US, have multiple exchanges and other trading venues. In the US, the NYSE and Nasdaq have different rules on corporate actions for securities listed on their exchanges, but OTC securities are governed by the FINRA regulator.

Comprehensive Coverage

Various providers claim to have comprehensive coverage based on 80,000 or 100,000 companies, in over 100 countries. The number of instruments is also important since some companies have multiple different bond and other fixed income issues, often trading in different countries.

Collection Techniques

Manual sourcing of data increases potential for errors. Automation is a more efficient way to collect the data. The raw data can be efficiently collected and manipulated using bulk API.

Data Processing Standards

Various central banks, financial regulators and industry bodies can set standards and define rulebooks for corporate actions. A disparate range of standards can create extra work to harmonise data, and coordinate it with end users’ systems. Automation is improving solutions in these areas.