Benchmark Data – Global Access + Immediate Delivery

With over 200+ index data providers globally, from the behemoths to the new upstart index calculators, there has never been more choice in benchmark selection. Business requires a managed data service provider that can map to all of these in one feed, “out of the box” on day one.

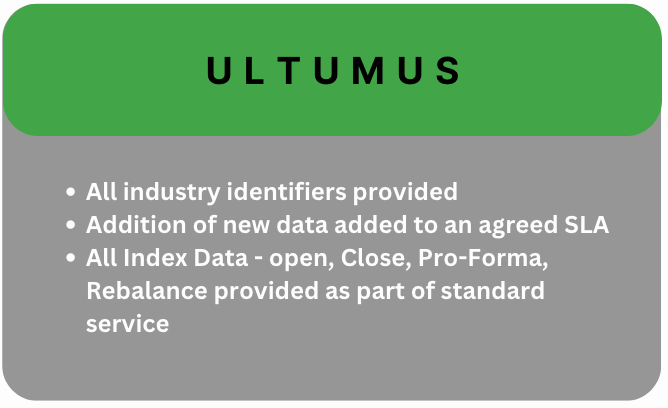

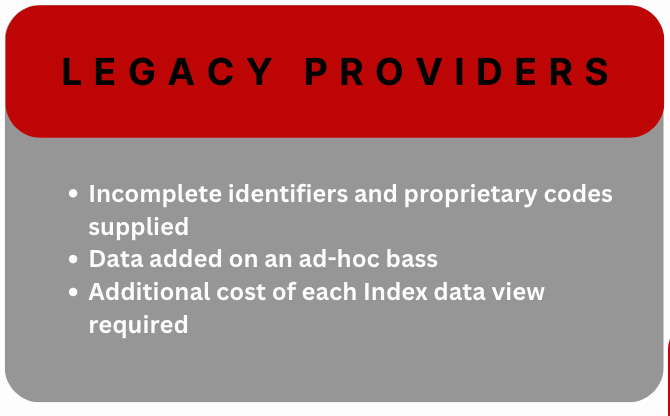

It’s essential that all identifiers at both the index and constituent levels are industry standard and allow clients to implement a vendor-agnostic framework, as opposed to locking themselves into a customised feed, littered with proprietary codes which limits options to change service provider.

This is becoming more and more prevalent with the various asset classes that are now being embedded into benchmark data, from equity, fixed income, commodity, crypto, futures and options, the variety of data points and identifiers can vary inside one benchmark, with the smorgasbord approach across the industry. Having a data provider that is able to adapt to the changing and evolving industry is essential.

As clients add new indices to pursue an investment opportunity, the key is speed and agility in having data added and to ensure that the client can work in partnership to maintain any index licenses required for the delivery or avoid any situations where they are in breach of said licenses.

Benchmark data varies hugely between index providers and the level of data that is supplied often inconsistent and/or requiring explanation – the most successful organisations work with a managed data service provider who understand the full lifecycle of index data from open, close, pro-forma and rebalance with a solution that is equally appropriate for asset management or trading.