Ultimate Guide to Managing ETF Data

Despite the name, fixed income ETFs broadly defined can own either fixed income or floating interest rate securities, or potentially a mix of the two. Over 11,000+ ETFs are listed on over 50 exchanges worldwide. In turn, they can potentially track thousands of indices, and own thousands of instruments, which may be traded on exchanges or other venues.

Fixed Income ETFs

Fixed Income ETFs can own either or floating interest rate securities, or potentially a mix of the two

ETF Composition

ETFs can hold various weightings of different asset classes, including cash, equities, bonds, commodities, currencies and cryptocurrencies

ETF Strategy

ETFs have become an important building block for implementing investment strategies, since they offer liquid and low cost exposure to so many asset classes and markets

ETF Issuers

ETF issuers are mainly asset managers who are experts and track assets, inflows and outflows across the industry

Understanding Global Aggregation

Over 11,000 ETFs are listed on over 50 exchanges worldwide. In turn ,they can potentially track thousands of indices, and own thousands of instruments, which may be traded on exchanges or other venues.

All of this complex and constantly changing market, ETF and index data needs to be aggregated, cleaned, and harmonised into a single data feed for the benefit of buy side and sell side.

Basket data on multi-asset ETFs

Multi-asset ETFs could own cash, equities, various fixed income sub-asset classes, commodities, currencies, and cryptocurrencies

Flow data

ETF inflows and outflows can indicate trends in investor behaviour as well as product launches and closures.

Dividends

ETFs need accurate data to handle dividends from their underlying holdings, which can include long or short positions in single stocks, index futures, and other ETFs.

API for programmatic consumption

APIs are like the arteries and veins of the body, but instead of delivering blood and oxygen to organs, APIs deliver data to end users

UI for desktop usage

A user friendly user interface full of handy dashboards makes workflows much more efficient.

Global support team

As well as virtual chatbots on the ULTUMUS site, there are real human people available around the globe and round the clock

ETF production

Other asset managers could act as advisers to a third party managed ETF, which might be a white-label ETF platform that handles the legal, regulatory and operational aspects of establishing and running ETFs

ETF distribution

ETF distribution means making the product accessible to investors, by listing an ETF on more exchanges, often with more different currency share classes

ETF trading

ETFs trade round the clock for two reasons. They can be listed on multiple exchanges in different time zones. And in some markets such as the US, pre-market and post-market trading on top of exchange opening hours mean that ETFs effectively trade 24 hours a day and 5 days a week.

ETF Operational Considerations

Operational Functions

ETF operational models have historically been fragmented and disparate, but are increasingly adopting models summed up by acronyms such as STP (Straight Through Processing), LPO (Lean Process Optimisation), RPA (Robotic Process Automation), and using SaaS (Software as a Service).

Regulatory Functions

ETFs need to comply with a wide range of financial, securities, tax, and other regulations. Examples include European Market Infrastructure Regulation (EMIR) in the EU, and Foreign Account Tax Compliance Act (FATCA), which is a US regulation that can be extraterritorial in scope.

Marketing Functions

Marketing can be done in house by ETF issuers, or it may be left to distributors. Social media literature, podcasts, and videos promoting ETFs need to pay careful attention to regulation and compliance in the relevant jurisdictions.

Outsourcing ETF Functions

Most ETF issuers will outsource to varying degrees, in areas such as settlement, custody, securities services, fund accounting, proxy voting, valuation, and security lending. Even when ETF issuers do some of these things under a common top level corporate umbrella, there could be several corporate sub-entities carrying out different functions.

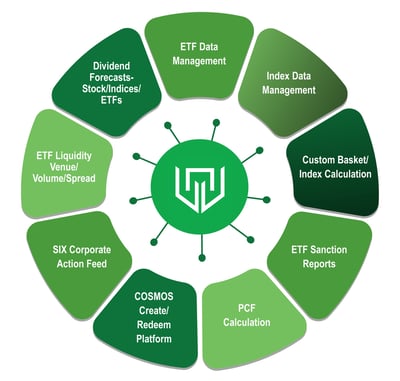

ETF Solutions

PCF Calculations

ULTUMUS is the largest ETF calculation agent globally calculating Portfolio Composition Files, which can include cash, securities, futures and other derivatives, swaps, other ETFs, and other line items, such as currency hedges.

ETF Aggregation

A holistic ETF aggregation service ties together portfolio composition and basket data, including creation and redemption data, reference data, flow data and corporate actions such as dividends per instrument. Both the raw source data and tags for various entities from issuer to umbrella, fund, sub-fund, share class, listings and associated legal entity identifiers need to be timely and validated.

ESG Scores

ESG scores and categories can involve global standards, such as UNPRI (United Nations Principles for Responsible Investment), or may be specific to geographic regions. For instance, in the EU, some ETFs are making disclosures under articles 6, 8 or 9 of the SFDR (Sustainable Finance Disclosure Regime) while others may even opt out of the SFDR.There are also numerical rankings from groups such as MSCI.

Corporate Action Feeds

A comprehensive, global and dynamically updated corporate action feed should capture and account for all corporate actions from M&A to spin offs, rights issues and other offerings, cash and scrip dividends, index additions, deletions and rebalancings, and other items.

Index Aggregation

Most ETFs are designed to track an index. They need a license to do so and they also need to track its price and constituent weightings accurately in real time during market hours. ULTUMUS offers a managed data index service that gathers data from over 400 index providers from the household name giants to a growing variety of niche index providers.

Fixed Income Reference Data

Fixed income reference data is more complicated than equity reference data as there are so many more instruments which change more often. There are millions of actively traded fixed income instruments listed on over 100 markets, which can include exchanges as well as other sorts of trading venues since some of these markets are still mainly over the counter (OTC).

Understanding ETF Benchmarks

ETF benchmarks are indices that form the foundation for most ETFs, since most are passive products designed to track an index. Many indices such as the S&P 500 or Nasdaq 100 are also widely used as futures contracts, mutual funds, swaps and other sorts of funds. Some more niche indices can be exclusively used by one or more ETFs. Licensing fees for using indices can be expensive and it may be more cost effective to access them through an index aggregator as part of a managed data service, which also helps with index calculation and feeds the relevant data into parties such as APs, which create and redeem ETFs the primary market.

Blackrock

BlackRock owns iShares, which was founded in 1996 and has become the largest ETF provider worldwide by assets.

Vanguard

Vanguard is the second largest provider of ETFs overall in the Americas, and the largest provider of fixed income ETFs in the Americas.

Validated data

ETF pricing data, and the market and index data that feeds into ETF pricing need to be validated at multiple levels: metadata, web services, datasets, and APIs.

Niche players

There are dozens of niche players, which ULTUMUS often highlights under UlTUMUS Insights. They include HANetf, Defiance, Rize, and Roundhill Investments, to name but a few.

Client bespoke APIs

Index and ETF data can be delivered via client bespoke APIs, tailored to client structure and requirements.

Amazon Web Service (AWS) stack

The cloud based AWS Stack is renowned for high performance and reliability.

DWS

DWS Xtrackers, which launched in 2007, is the second largest ETF provider in Europe after iShares, both overall and for both equities and fixed income.

ETF Aggregation for Sell Side

Start of trading

The first ETF was the SPDR SPY, tracking the S&P 500 index of US equities, which started trading in 1993, and is the largest US and global ETF by assets today.

ETF Providers

ETF providers are mainly asset managers but they can also be white label platforms used by multiple asset managers.

ETF Data Products and Tools

The disparate and fragmented data landscape for ETFs places a premium on data aggregation solutions, for both ETFs and indices, which should be integrated, clean and technically robust.

ETF Data Delivery

ETF data needs to be delivered in a user friendly format, through feeds and solutions. Clients should be able to access snapshots of historical and current ETF data at any point in time.

ETF Analysis and Analytical Tools

ETFs can be analysed with standard portfolio optimisation software, with multiple open source packages available on the web as well as a huge variety of vendor solutions. The breadth of the ETF universe means that a huge library of data covering different asset classes, geographies, markets and instruments would be needed for comprehensive analysis of a very diverse ETF portfolio.

What is an ETF on Wall Street?

“Wall Street” was once the home of the US stock-market, but nowadays banks, brokers, market makers, exchanges and other venues for trading ETFs could be based in many locations in New York, and other cities. However the term “Wall Street” is broadly used to describe US financial markets, therefore an ETF on Wall Street could be listed on many exchanges. The NYSE (New York Stock Exchange) is indeed the largest home for ETF listings, but they can also be listed on the Nasdaq and its multiple exchanges, and/or other venues. Some ETFs may be listed and traded on multiple exchanges and venues in the US.

What is a XRP ETP?

An XRP ETF is simply an ETF that tracks the price of the Ripple cryptocurrency.

Ripple itself has the symbol XRP, and if you trade XRP directly on a platform such as Coinbase, you can enter the ticker XRP, and currently ETFs exposed to Ripple do also contain these three letters. For instance, the first Ripple ETP, 21 Shares ripple ETP, launched in April 2019, has the ticker AXRP.

This Swiss-domiciled product is 100% physically backed by Ripple. It is listed on SIX Swiss Exchange (the parent of ULTUMUS) as well as Euronext Paris, Euronext Amsterdam; Boerse Stuttgart; Gettexl Deutsche Boerse Xetra; BX Swiss and Boerse Duesseldorf. Three currency share classes are available: USD, Euro and Swiss Franc.

Another Ripple ETF also from a Swiss issuer, Valour, Valour Ripple (XRP) launched on the Swedish stock exchange in February 2024. This has a base currency of Swedish Krona. However, any future launches of other ETFs wholly or partly tracking Ripple could have different tickers.The growing number of Bitcoin ETFs do not always contain the letters BTC in their ticker.

Got a Question? No Problem.

Need more detail? Here are some useful managing ETF data links

ULTUMUS white paper - a comparison guide

This white paper outlines some of the key considerations when reviewing your managed data service provider for the Index Benchmark and ETF data.

Tier 1 Investment Bank Case Study

The ETF Industry has evolved the need to outsource operational

SIX_ULTUMUS-01-1 · Why Ultumus · Our Products · Global Index Aggregation · Global ... how ULTUMUS could be assisting your business download our brochure >>>.

Why Choose Ultumus's ETF & Index Aggregation Sevices

ETF and Index data is the backbone of what we offer at our company. We provide a singular focus on offering a real choice to trading desks

ETF MEME Investing Or how to hold GME

4 Mar 2021 — Using ETFS to get exposure to MEME stocks such as GME and AMC. Learn more about ETF Meme Investing from ETF Data Specialists - Ultumus.

Global ETF Managed Data Service

Internal stakeholders demand ETF data that is validated

Subscribe to Insights and News

Sign up and let us send you the latest news articles

Global Corporate Action Service

Deep data coverage Receive corporate actions with individual sub-events and related single messages to ensure you are always well-informed. Flexible delivery ...

Global Index Management Data Service

... to us to contact you about our products and services. You may unsubscribe from these communications at any time. For information on how to unsubscribe

People Also Ask...

What are the common pitfalls of ETF data management

How do I monitor ETF performance

What are the most important metrics for an ETF

What is the best benchmark for ETF

Who is the largest active ETF manager

How do you know if an ETF is overvalued

How do you know if an ETF is a good buy

How do I check my ETF tracking difference

How do you know if an ETF is good

How do I balance my ETF portfolio

Is there an ETF for Sin Stocks

What downsides are there to ETF Stocks

How can credit & corporate bond ETFs be structured